How to Finance a Used Car in South Africa: Car Loan Tips, Instalments & More

The excitement of purchasing a set of wheels – even second-hand – is often tempered when it comes to the bottom line financial commitment. That is why, as your trusted partner in securing your next vehicle, we are here to help you crunch the numbers by giving you access to flexible vehicle financing options from South Africa’s top lending institutions.

For the average guy or gal on the street, paying cash upfront for a vehicle – even a used car – is generally not a given. That is why negotiating a car instalment plan is a legitimate solution that can be tailored to your needs.

Understanding car instalments for second-hand cars

Buying a used car from a reputable dealership is a smart choice for quality and value.

Here’s how car instalments work:

- Initial deposit: This will reduce the total amount financed. The size of this deposit is flexible and can be adjusted based on your financial capacity.

- Loan amount and interest: The remaining balance, including interest, is divided into manageable monthly instalments. Competitive interest rates ensure that your payments remain affordable throughout the loan term, but the longer the term, the more overall interest will be paid. (Your credit score and financial history do play a role in determining the interest rate you’ll be offered) .

- Flexible repayment period: You can select a repayment period – usually from 12-72 months – that suits your financial goals. Longer terms reduce monthly payments, while shorter terms allow you to pay off your loan faster.

- Ownership: Once all instalments are paid, you own the car outright, giving you equity in a valuable asset.

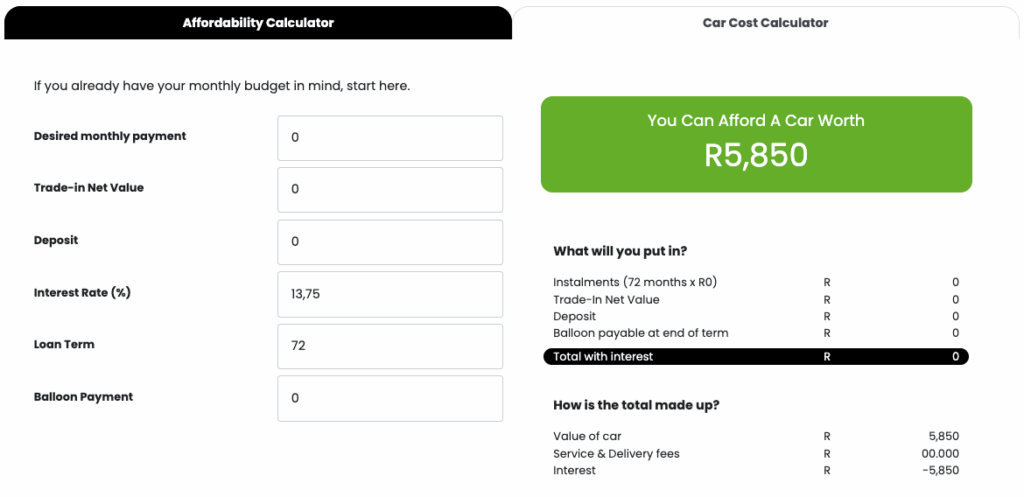

Know what you can afford with our affordability calculator

Benefits of financing a second-hand car

- Lower costs: Second-hand cars typically have a lower purchase price compared to new vehicles, which means lower loan amounts and reduced monthly payments.

- Depreciation: Used cars depreciate at a slower rate than new cars, preserving more of your investment over time.

- Quality assurance: All our second-hand cars undergo rigorous inspections and come with warranties, ensuring you receive a reliable vehicle.

1. Can I buy a car with a R5,000 salary?

While it’s possible to obtain vehicle financing with a R5,000 monthly income, approval depends on factors like your credit score, existing debts, and the affordability assessment conducted by the lender. Generally, lenders prefer that your total monthly debt repayments, including the car installment, do not exceed a certain percentage of your gross income to ensure affordability.

2. What is a good credit score to buy a car in South Africa?

A good credit score in South Africa typically ranges from 650 to 699, with scores above 700 considered excellent. A higher credit score increases your chances of loan approval and may qualify you for more favorable interest rates.

3. Can I buy a car without a payslip?

Purchasing a car without a payslip is challenging, as lenders require proof of income to assess your repayment ability. However, if you’re self-employed or earn income through alternative means, providing bank statements, tax returns, or audited financial statements may suffice as proof of income.

4. What is the minimum salary for a used car loan?

There isn’t a standardized minimum salary for obtaining a used car loan in South Africa, as requirements vary among lenders. However, a higher income improves your chances of loan approval and may grant access to better loan terms.

5. What’s the lowest credit score to finance a car?

While there’s no universally defined minimum credit score for car financing, scores below 580 are generally considered poor, making loan approval difficult. Lenders may still offer financing to individuals with lower scores, but this often comes with higher interest rates and stricter terms.

Car Financing Tips:

We understand that car financing can feel overwhelming, especially with rising interest rates and hidden costs. Whether you’re buying new or pre-owned, getting the best deal comes down to being informed, knowing your budget, and negotiating smartly. Before signing any contract, it’s essential to understand how interest rates, balloon payments, and loan terms will affect your monthly repayments and total cost. Most importantly, never let the excitement of the car distract you from the financial commitment you’re making.

Car Financing Tips to Get the Best Deal in South Africa:

Know Your Credit Score: A higher score gets you lower interest rates. Check your credit report before applying for finance.

Compare Interest Rates: Don’t settle for the first offer. Compare quotes from banks, dealerships, and third-party lenders.

Understand the Total Cost: Consider the full loan term, including initiation fees, service fees, and interest – not just the monthly repayment.

Avoid Balloon Payments If Possible: While they reduce monthly payments, you’ll owe a large lump sum at the end of the term.

Choose the Shortest Term You Can Afford: Longer terms mean more interest paid over time.

Get Pre-Approved: It strengthens your negotiating power and shows sellers you’re serious.

Negotiate the Car Price First, Then Talk Finance: This prevents dealers from manipulating finance to cover inflated prices.

Don’t Add Extras to the Loan: Items like insurance, warranties, and tracking systems can inflate your monthly repayment unnecessarily.

Read the Fine Print: Look out for early settlement penalties and hidden fees.

Ready to get started?

Our friendly and experienced Weelee sales team are here to guide you through every step of the vehicle financing process. We offer personalised advice to help you choose the best car instalment plans for your needs.

Visit our Weelee Centurion or contact us online to learn more about our financing options and to find the perfect car for you.